As it turns out, suburban sprawl actually peaked 20 years ago

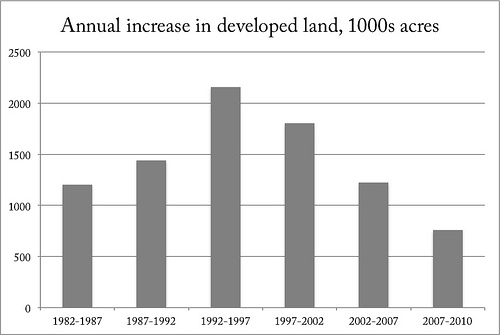

The rate of suburban sprawl peaked in the mid-1990s and has declined by two-thirds since then, even through the giant housing boom. Could this quiet change in land use have caused many of the changes that we’re seeing today, from recentralizing job growth to the decline in driving?

According to the USDA’s 2010 National Resources Inventory, which tracks land use with satellite imaging surveys, the inflection point for suburban sprawl peaked in the mid-1990s, just as “smart growth” emerged onto the national scene. That’s before the giant housing bubble showered suburbs with seemingly limitless sums of capital.

It’s been slowing ever since then, even though metro population growth moderated only slightly (see graphs on page 3). Interestingly, non-metro population growth (including distant exurbs beyond metro area boundaries) in the 2000s fell much faster than metro population growth.

It’s interesting that the slowdown in sprawl, like the slowdown in mall construction, predated “peak car” by 10-15 years. The directionality might be backwards: the 1980s cessation of massive freeway construction may have pushed many metro areas into some version of Marchetti’s Wall: the theory that people don’t want to travel more than one hour a day, and thus that metropolitan growth has geometric limits tied to how far the predominant mode of travel goes.

Edge Cities, which relocated commercial uses into the inner suburbs, could only extend the outward trend so far; with a few notable examples, attempts at building Edge Cities in outer-ring suburbs has largely failed, since there’s no meaningful centrality amidst the undifferentiated masses of one-acre lots. Second-generation Edge Cities rarely thrived, because without new beltways there just wasn’t the population base to feed them.

To this day, 80% of the office market in metropolitan DC is within three miles of the Beltway, using Cassidy Turley‘s submarket definitions. Joel Garreau wrote that in the late 1980s, Til Hazel “had major projects at half the exits on Interstate 66 from the Beltway to…Manassas,” but ultimately, that future didn’t pan out.

Reston and Herndon, located 10 miles from the Beltway and 20 miles from the White House, are the notable exceptions that proves the rule. Fair Oaks and Gaithersburg, located 17 and 19 miles from downtown DC respectively, are doing just fine. But almost 35 years after their shopping malls opened, they’re still ultimately peripheral locations relative to the metro area.

Even in metro Boston, which uniquely among Northeast metros actually built an outer beltway, 73% of the office market is within the urban core or inner ring, and the urban core commands per-foot prices more than twice as high.

If you consider that the area of a circle grows with the square of its radius, a slowdown in the areas developed for sprawl would imply a much steeper decrease in the radius of metro expansion. This could imply another overlooked factor in the slowdown in VMT growth, or vehicle miles traveled: since metro areas are no longer getting geometrically wider, thus distances between metro-area destinations are no longer growing as fast.

A majority of the VMT benefits from more-central locations come from the fact that destinations are closer and car trips are shorter; only a minority of the benefits come from a switch to other modes. As growth recentralizes, perhaps VMT can be expected to decline further.

A version of this post appeared on West North.